There is no single manner or ideal way to determine the cost of the sales object.

Whether calculating the sales price or the profitability margin of a given price, there are many costing alternatives, each meeting particular pricing and profit needs.

While for one offerer it is advisable to use absorption costing, effective cost, and average cost, for another, it may be better to apply ABC costing, target cost, and standard cost.

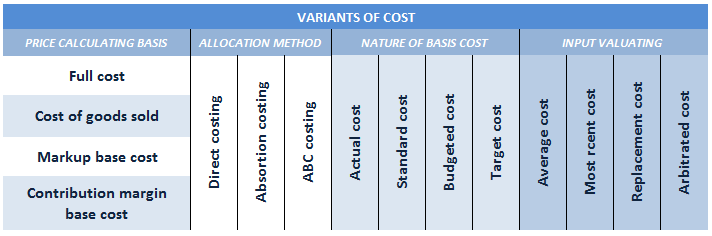

Despite the countless existing cost variants, we will focus on those that meet the usual pricing needs outlined in the table below.

As expounded, these variants are the result of four types of parameters:

– the cost basis for calculating the sales price and the profitability margin,

– the method of allocating the cost to the object of sale,

– the nature of the cost that serves as the calculation basis, and

– the criterion for valuing the inputs, products, and services used.

The cost basis for calculating the price and the net margin, gross margin, markup margin, and contribution margin of sales is the full cost, the cost of the product sold, the markup base cost, and the contribution margin base cost, respectively.

The cost allocation methods are direct costing, absorption costing, and ABC costing.

The natures of the cost basis are actual, standard, budgeted, and target costs.

Lastly, the criteria for valuing the inputs, products, and services that compose the sale object are average, most recent, replacement, and arbitrated costs.

Any cost variant can fit to calculate the prices and sales profitability. However, the decision of which to apply is not to be taken lightly. The price manager must consider various factors, such as the field of activity, company specificities, market characteristics, information availability, stakeholder demands, or even the offerer’s preferences.

This responsibility ensures that the chosen method aligns with the company’s goals and needs

C. L. Eckhard, author ofPricing in Agribusiness: setting and managing prices for better sales margins.

Claudio Luiz Eckhard is a former professor, business consultant, and author of the books “Ajustando o Rumo”[Adjusting the Business Course], “Gestão pela Margem”[Management by Margin], “A Empresa Saudável”[The Healthy Company], and “Pricing no Agribusiness”[Pricing in Agribusiness].

Claudio Luiz Eckhard is a former professor, business consultant, and author of the books “Ajustando o Rumo”[Adjusting the Business Course], “Gestão pela Margem”[Management by Margin], “A Empresa Saudável”[The Healthy Company], and “Pricing no Agribusiness”[Pricing in Agribusiness].