A cost object is any entity or process that one wants to identify its cost.

Samples of cost objects are a product (e.g., grape juice), a supplier service (e.g., storage), an activity (e.g., wild boar farming), an industrial unit (e.g., biodiesel plant), a commercial unit (e.g., convenience store), an agricultural process (e.g., fumigation), a sales operation (e.g., customer order), and so on.

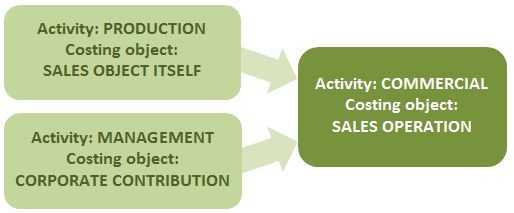

In pricing, the most relevant cost objects are the sales object itself, the corporate contribution, and the sales operation, the two first remaining absorbed by the last, as illustrated in the following figure:

In manufacturing, the production activity generates the cost of the sales object itself, which is composed of raw materials, labor, and general spending. For its part, management activity gives rise to the cited corporate contribution, which includes commercial, administrative, and financial expenses. These two costs, added together, inform the cost of the sales operation.

The sales operation cost compared to its revenue indicates its profitability. This result can refer to a single product, an order for several products, all sales to a customer, sales over a certain period, or sales of the entire company.

The costing methods applied to the cost object are the same as mentioned in another post: direct, absorption, and ABC.

When determining the cost of the sales object itself (the production cost or cost of the good sold), one uses direct costing for raw materials and direct labor and, in turn, absorption costing or ABC costing for indirect labor and general spending. Whether calculating the corporate contribution to the sales object, one uses direct costing for taxes, commissions, and other direct expenditures, as well as absorption or ABC costing for indirect commercial, administrative, and financial expenses.

In addition to these three costing methods, many firms, especially retailers, calculate sales prices using the markup and contribution margin alternatives, which already have implicit the offerer’s intended profitability.

C. L. Eckhard, author of Pricing in Agribusiness: setting and managing prices for better sales margins.

Claudio Luiz Eckhard is a former professor, business consultant, and author of the books “Ajustando o Rumo”[Adjusting the Business Course], “Gestão pela Margem”[Management by Margin], “A Empresa Saudável”[The Healthy Company], and “Pricing no Agribusiness”[Pricing in Agribusiness].

Claudio Luiz Eckhard is a former professor, business consultant, and author of the books “Ajustando o Rumo”[Adjusting the Business Course], “Gestão pela Margem”[Management by Margin], “A Empresa Saudável”[The Healthy Company], and “Pricing no Agribusiness”[Pricing in Agribusiness].